Managing your finances and preparing for tax season can be overwhelming when you’re a small business owner. The right accounting software can simplify your workflow, automate invoices, and help you get a clear picture of your business’s financial health. This guide will help you find the best accounting software for your small business and show you a selection of top options to help you make the best choice.

Accounting software can help you efficiently manage your finances. It also helps you prepare you for annual tax filing and your invoices. It is not just for big businesses, but also very helpful for small businesses to be more efficient.

What is the best accounting software for small business? How do you even begin to look for one?

What is an accounting software

An accounting software is a very useful tool that can help you manage and control your finances even if you have no or limited accounting experience. It can help you fill in your general ledger for your accounts payable and accounts receivable. Your software can help you see how much you are spending, how much you are earning, how you are doing with your sales or financial goals, and the like.

Depending on your provider, some software can be cloud-based, which you can easily access and manage online wherever you may be. It can also allow you to manage and automate your invoices and payrolls, as well as help you prepare for your annual tax filing.

How does an accounting software work (features)

Different providers offer different accounting features depending on your package subscription. Most of the best accounting software for small business offer the following features:

- manage accounts payable and receivable (general ledger)

- payroll management and automation

- expense tracking and management

- invoice management

- analysis tools (reports)

- payment system integration

- tax report filing

- inventory management

- mobility (cloud-based, access on mobile phone, desktop, android, IOS devices)

- customer management system

Why do you need an accounting software

Even small business operators can take advantage of the benefits of an accounting software. When you have a growing business, time and money are very important. Having a tool that can automate and help manage the financial aspects of your business can definitely help you save a lot of time and effort, and thus, money. The resources you save can productively be used for other matters that can grow your business.

Accounting software can also help you make better decisions for your business. By looking at the reports, you can analyze different aspects of your business that needs to be worked on or maintained. It can help you generate better financial strategies for your business.

How to find the best accounting software for your small business

It can be overwhelming to choose from so many accounting software available today that come with different features and different costs. To choose the best one, here are some factors to consider:

Industry

Choosing the right software depends on the industry you are in. A freelancer might need a different type of accounting software that an online retail store owner or a manufacturing business owner might need. It is important to look for an accounting software that caters to the type of business you have and the industry you are in.

Cost

The cost of the accounting software is another factor to look into. Considering that you are operating a small and growing business, find a provider that serves its purpose without breaking the bank. You may check out free accounting software or those that offer a free trial so you can have a feel of using their software.

Features

Decide on the features you need for your accounting software. Your business may not require all the complicated accounting software features for big businesses. Maybe you want to look into the accounts payable and receivable tools, inventory tools, the reports you need to generate, and other features like payroll management, time tracking, or maybe payment systems integration. You may also want to look into added features like mobile accessibility, cloud-based software, and third-party integrations.

Ease of use

Find software that is easy to set up, navigate, and manage. You can read reviews of different accounting software. Users most likely give feedbacks on software’s ease of use.

Customer support

Aside from ease of use, do read about customer service. Is the provider responsive to the queries and concerns of its users. Does the provider offer 24/7 support in different platforms (e.g. email, chat, etc.)? Do they offer other resources, such as tutorial or FAQ page? These things are worth looking into.

Credibility

Finally, look at the overall credibility of the software and its provider. How many active users does the software have? How are its ratings? Are they being reviewed positively by different blogs and websites?

What are the best accounting software for small businesses

We have outlined some of the best accounting software for small business that offer the basic features you need with simple and intuitive design and offered for a reasonable cost.

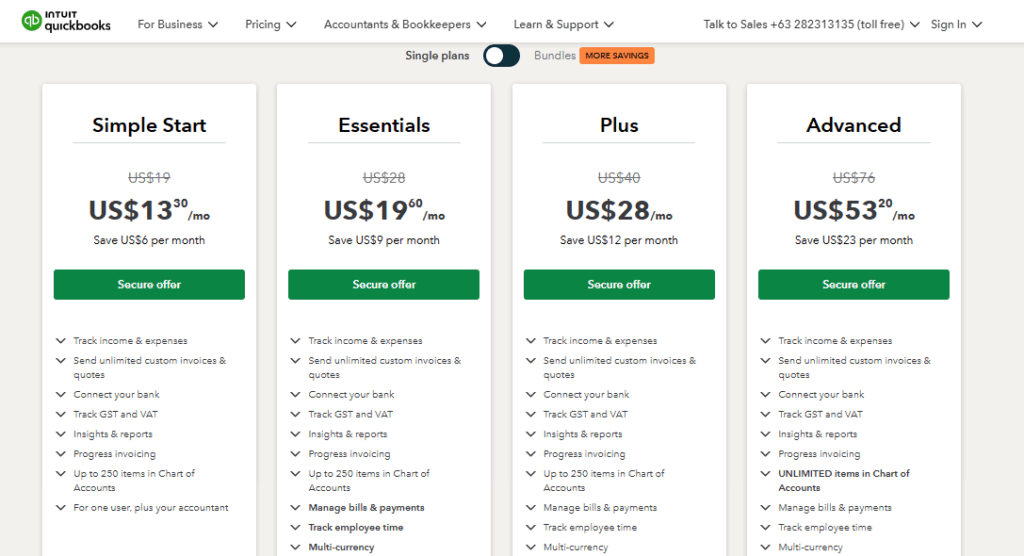

1. QuickBooks

QuickBooks, developed by Intuit, remains the market leader in small business accounting software. It provides simple yet powerful accounting solutions designed to help your business grow. Known for its comprehensive features and wide range of integrations, it is often named the best overall choice for small businesses.

QuickBooks Online Advanced: Starts at around $235 per month, offering more comprehensive tools for larger teams.

QuickBooks Online Simple Start: Starts at around $35 per month for basic bookkeeping and invoicing.

QuickBooks Online Essentials: Starts at around $65 per month, adding features like bill management and multi-user access.

QuickBooks Online Plus: Starts at around $99 per month, which includes inventory management and project profitability tracking.

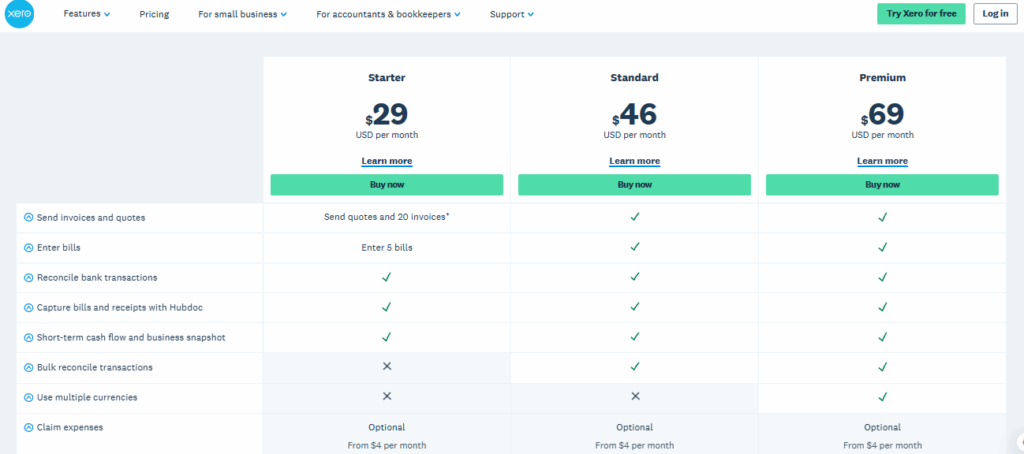

2. Xero

Xero is a highly-rated, cloud-based accounting software, especially popular among micro-business owners and freelancers. It is known for its clean, intuitive interface and unlimited user access on all its plans. Xero’s strength lies in its ability to handle core accounting tasks with ease, including third-party app integration and comprehensive reporting.

Xero Established: Starts at around $90 per month, adding multi-currency support and more advanced project tracking.

Xero Early: Starts at around $25 per month, allowing for a limited number of invoices, quotes, and bills.

Xero Growing: Starts at around $55 per month, with unlimited invoices and bills.

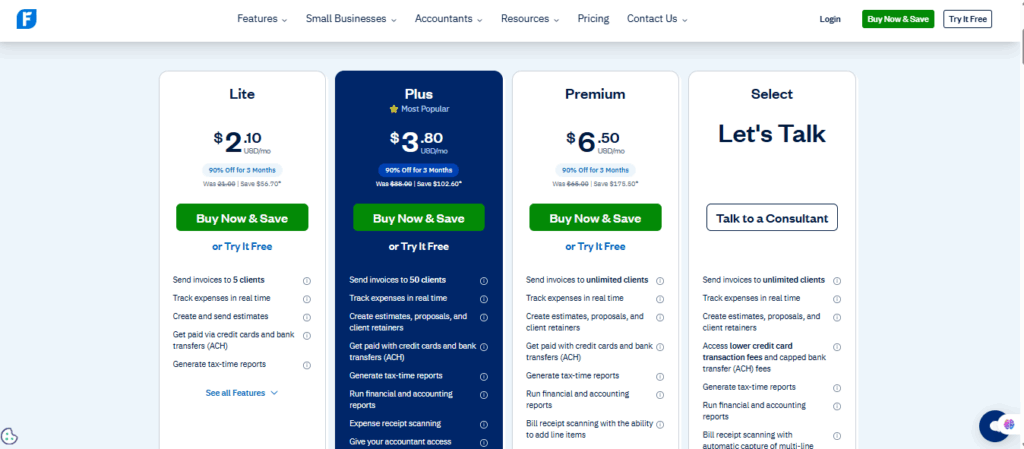

3. Freshbooks

FreshBooks is an excellent accounting software option if you have a service-based business. While it has limited features for inventory, it has an outstanding, customizable invoicing tool and provides unlimited invoices and estimates across all plans. It is celebrated for its user-friendly interface and robust time-tracking features.

FreshBooks Premium: Starts at around $65 per month for unlimited billable clients.

FreshBooks Lite: Starts at around $21 per month for up to 5 billable clients.

FreshBooks Plus: Starts at around $38 per month for up to 50 billable clients.

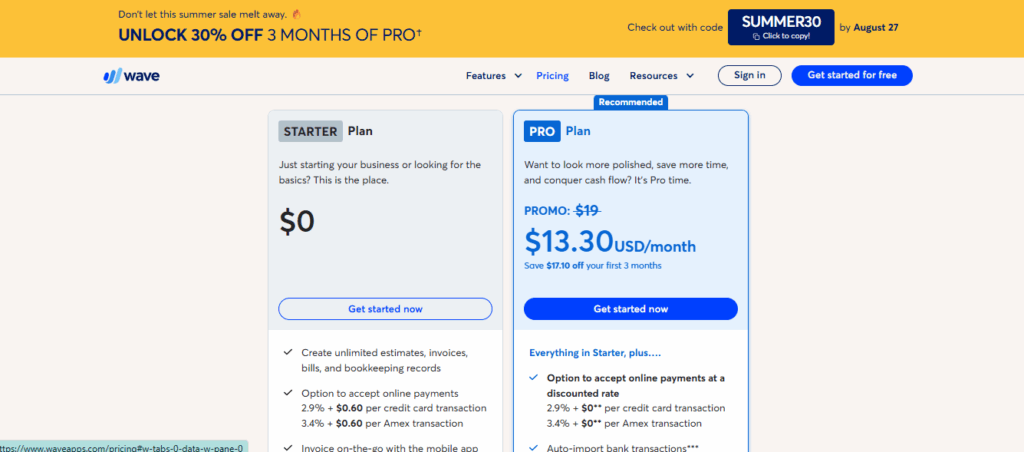

4. Wave

Wave is the top choice for businesses looking for a truly free solution for their accounting needs. Ideal for freelancers and small service-based businesses, Wave provides a robust suite of tools without a monthly fee. Its user-friendly interface supports double-entry accounting, unlimited invoicing, and expense tracking.

Payroll: This is a paid add-on service with a monthly fee plus a per-employee fee.

Accounting & Invoicing: Free. Wave does not charge a monthly fee for its core accounting tools.

Payments: Wave charges a percentage-based fee per transaction for payment processing.

Conclusion: Empower Action

Key Takeaways: There are many great accounting software options available for businesses of all types and sizes. The important thing to remember when choosing the best one for your small business is to find a solution that caters to your specific needs, provides good value for your money, has a reliable and user-friendly interface, and offers great customer support.

Actionable Steps:

- Assess Your Needs: Before you start your search, make a list of the features you absolutely need for your business, such as payroll, inventory, or advanced reporting.

- Take a Free Trial: Utilize the free trials offered by most providers to test the software and ensure it is a good fit for your workflow.

- Read Reviews: Look for recent reviews and testimonials from other small business owners in your industry to get a better idea of a software’s real-world performance.

Ready to take control of your small business finances? Start your free trial with one of these top accounting software options today!

Frequently Asked Questions

Is free accounting software really free?

Yes, some accounting software providers like Wave offer a completely free service for their core features, with revenue coming from optional paid services like credit card processing or payroll.

When should a small business upgrade from free to paid software?

A business should consider upgrading when their needs outgrow the free software’s capabilities, such as needing more advanced reporting, unlimited integrations, or support for a larger number of users and transactions.

Can accounting software help with my annual taxes?

Yes. Most modern accounting software helps you by generating financial reports (like profit and loss statements) and tracking expenses and income, which makes preparing for annual tax filing much more organized and efficient.

Is cloud-based accounting software secure?

Yes, reputable cloud-based accounting software providers use high-level encryption and security protocols to protect your data, making it often more secure than keeping financial records on a single, local computer.

Recommended reading: APE: Internet Marketing Criteria for Small Businesses and Startups