Have you ever stopped to consider how profoundly digital payments have transformed the way we interact with our favorite online games? In Southeast Asia, a region with one of the fastest-growing digital economies, the traditional reliance on credit cards is rapidly diminishing. Instead, innovative payment methods like digital wallets and mobile top-up services are not just facilitating transactions; they are fundamentally reshaping how online games are accessed, monetized, and enjoyed. This shift is particularly pronounced within the booming gaming and entertainment sectors, where accessibility and speed are paramount.

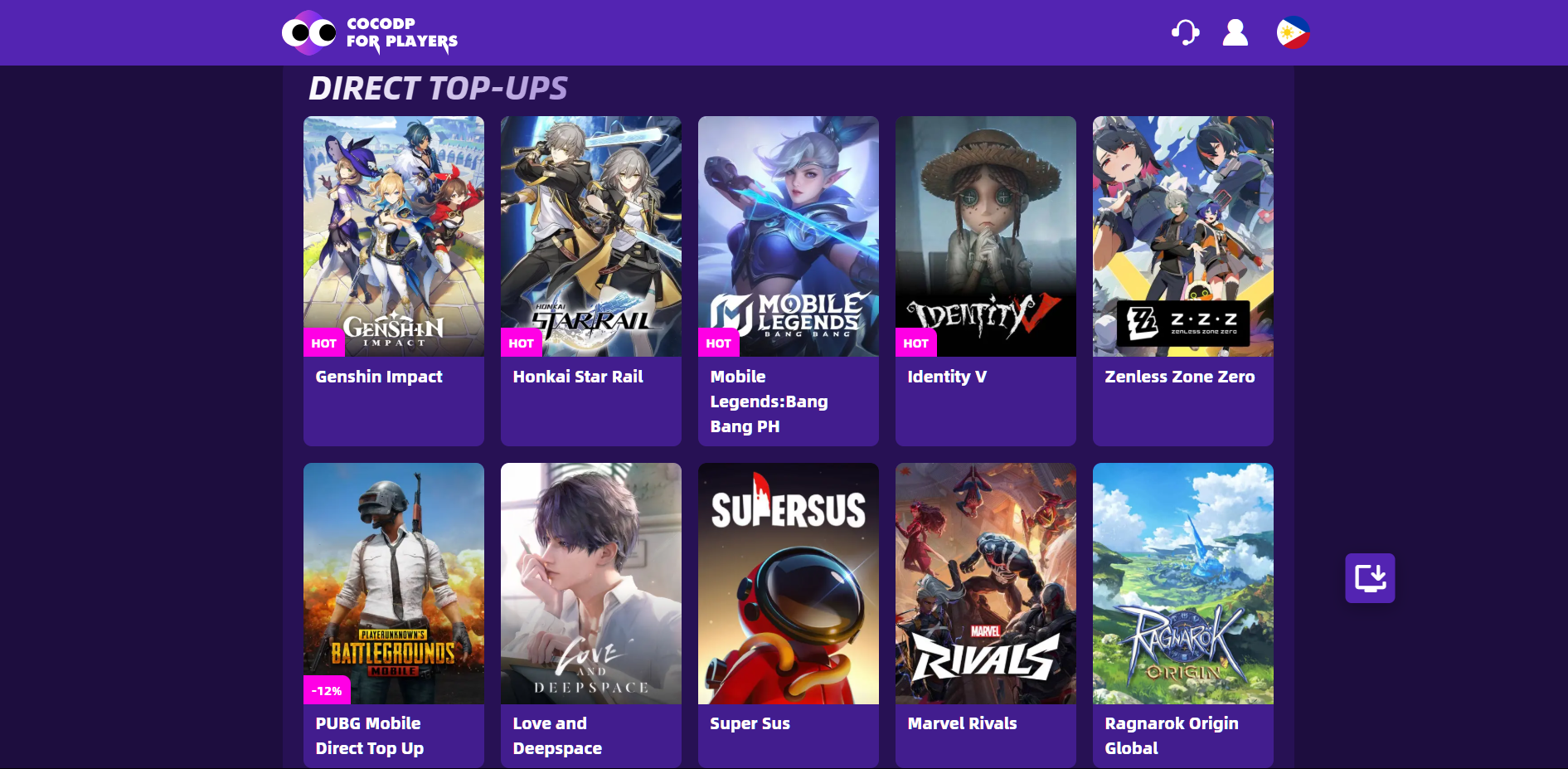

The burgeoning online gaming market in Southeast Asia presents a unique landscape for financial innovation. Millions of players, many of whom are unbanked or underbanked, require convenient and secure ways to purchase in-game items, subscriptions, and new titles. This is where digital payments SEA gaming truly shine, providing the necessary infrastructure for seamless micro-transactions and broader financial inclusion. Companies like Cocodp exemplify how local providers are crucial in this shift, offering accessible solutions. The integration of these modern payment systems is not merely a convenience; it’s a strategic move that significantly lowers barriers to entry, expands revenue streams for developers, and enhances the overall player experience through advanced technological implementation.

In this article, we will explore how digital wallets and mobile top-up services are at the forefront of this payment revolution, diving into their mechanisms, their impact on the SEA gaming economy, and the future trends that continue to shape online transactions in this dynamic region. You will learn why these payment methods are critical drivers of growth and how they are democratizing access to the vast world of online entertainment.

The Technological Shift from Traditional Payments in SEA Gaming

Historically, credit and debit cards were the go-to for online purchases globally. However, in much of Southeast Asia, low credit card penetration rates, combined with a strong preference for cash, created a significant barrier for online transactions, especially for the younger, mobile-first gaming demographic. This payment gap meant that millions of potential players faced hurdles when trying to buy in-game currency or access premium content. The underlying technological infrastructure simply wasn’t aligned with the prevalent consumer behavior.

The rapid proliferation of smartphones and increasing internet penetration laid the groundwork for a new era of financial inclusion. Gamers, often equipped with mobile devices but without traditional bank accounts, needed direct and immediate ways to pay. This demand spurred the rapid adoption and innovation of alternative digital payments tailored to the regional context, leveraging mobile-first technology to move away from conventional banking methods to more agile, app-based solutions. This transition, driven by advancements in mobile connectivity and payment processing, has been pivotal in unlocking the vast economic potential of the SEA gaming market.

Digital Wallets: The New Technological Standard for Gaming Transactions

Digital wallets, such as GrabPay, GCash, OVO, and GoPay, have become ubiquitous across Southeast Asia, evolving into comprehensive platforms that handle much more than just payments. For the gaming sector, they offer unparalleled convenience and security through sophisticated back-end technology. Players can link their bank accounts, credit cards, or top up their wallets with cash at physical outlets, then make instant, secure in-game purchases with just a few taps.

The technological architecture behind these wallets facilitates everything from buying skins and battle passes to subscribing to gaming services. Their seamless API integration into popular gaming platforms and mobile games has created a frictionless transaction experience, significantly reducing cart abandonment rates and boosting revenue for game developers. Furthermore, the robust security technologies embedded, including biometric authentication (fingerprint, facial recognition), tokenization, and advanced encryption protocols, provide a level of trust and fraud prevention often missing in less formal payment channels. The prevalence of these technologically advanced platforms has made digital payments SEA gaming synonymous with efficiency and user protection.

Mobile Top-Up Services: A Technological Bridge for the Unbanked Gamer

Alongside digital wallets, mobile top-up services play a crucial role, particularly in reaching the unbanked or underbanked population in Southeast Asia. These services leverage existing mobile network infrastructure, allowing users to convert physical cash into digital credits—often through convenience stores, telco kiosks, or direct mobile carrier billing. These digital credits can then be seamlessly used to purchase in-game items or load digital wallets. This method is incredibly popular because its underlying technology bypasses the explicit need for a bank account or credit card entirely.

For many gamers in remote areas or those without access to traditional financial institutions, mobile top-ups provide the primary technological gateway to the digital gaming economy. They effectively democratize access to gaming content, allowing anyone with a mobile phone and cash to participate in online transactions. This direct, low-friction link between readily available cash and in-game purchases, facilitated by widespread mobile network technology, is a critical factor in the impressive growth of digital payments in SEA gaming.

Mobile Top-Up Services: The Unseen Engine of In-Game Spending

A significant portion of the gaming community in Southeast Asia, particularly younger players, may not have access to traditional banking services or credit cards. This is where mobile top-up services play a crucial role, acting as a vital bridge between cash and the digital economy.

These services allow users to convert cash into digital credits, which can then be used for a variety of online purchases, including in-game items, currency, and other digital goods. This is often done through physical kiosks, convenience stores, or authorized agents where users can pay with cash to receive a code or have their mobile wallets credited directly.

Examples of Mobile Top-Up in Action:

- Direct Carrier Billing: Many mobile operators in the region have partnerships with game developers. This allows gamers to charge in-game purchases directly to their prepaid mobile balance or have them added to their postpaid phone bill. This is a frictionless way to pay, as it doesn’t require any additional accounts or financial information.

- Voucher-Based Systems: Gamers can purchase physical or digital vouchers from a wide range of retailers. These vouchers contain a code that can be redeemed within the game or on a gaming marketplace to top up their account balance. This is a popular method for those who prefer to use cash.

- E-wallet Integration: As discussed in the previous section, super apps and dedicated e-wallets are increasingly being used for mobile top-ups. Users can load their e-wallets with cash at various physical locations and then use those funds for seamless in-game transactions. For instance, a player in the Philippines could top up their GCash wallet at a local sari-sari store and then use that balance to buy items in Mobile Legends: Bang Bang.

The widespread availability and ease of use of these mobile top-up services are key drivers of monetization in the Southeast Asian gaming market. For game developers and publishers, integrating with these local payment solutions is not just an option but a necessity to tap into the full potential of this vibrant and growing player base.

Technological Benefits for Players and Gaming Companies

The widespread adoption of digitally driven wallets and mobile top-up services offers mutual benefits, stemming directly from their technological efficiencies, for both gamers and the gaming industry in Southeast Asia:

- For Players (Enhanced User Experience through Technology):

- Accessibility: Technology enables participation for unbanked and underbanked individuals.

- Convenience: Instant transactions anytime, anywhere via mobile devices and streamlined payment flows.

- Security: Advanced encryption and authentication tech reduces fraud risk.

- Cost-Effectiveness: Often lower transaction fees due to optimized digital processing.

- For Gaming Companies (Operational & Revenue Technologies):

- Expanded Market Reach: Taps into a broader player base previously excluded by traditional payment technologies.

- Increased Revenue: Simplified digital payment flows lead to higher conversion rates for in-game purchases.

- Reduced Friction: Fewer abandoned carts due to complicated, technology-dependent payment processes.

- Localized Solutions: Partnerships with regional digital payment providers allow for tailored, technologically integrated offerings specific to local market preferences.

Challenges and Future Technological Opportunities

Despite rapid growth, the landscape of digital payments in SEA gaming still faces technological and regulatory challenges. Fragmented technical standards and regulations across different countries in Southeast Asia, varying levels of digital literacy requiring user-friendly interfaces, and the continuous need for robust fraud prevention systems remain key areas for technological development. Ensuring interoperability and seamless data exchange between different digital wallet providers and gaming platforms is also an ongoing technological effort.

However, these challenges are met with significant opportunities. The continued rise of e-sports, the increasing sophistication of mobile gaming experiences, and the ongoing push for financial inclusion across the region will further cement the role of these payment systems. Future technological innovations like blockchain-based payments for enhanced transparency, greater integration with social media platforms for new payment touchpoints, and advanced AI-driven personalization of payment options are poised to further refine the user experience and create new monetization avenues. Companies like Cocodp are examples of local entities contributing to this evolving digital payment ecosystem through their accessible top-up and digital currency services.

Key Digital Payment Facilitators & Solutions for SEA Gaming

To fully grasp the technological ecosystem of digital payments SEA gaming, it’s helpful to identify the types of entities and solutions that facilitate these transactions:

- Regional Digital Wallet Providers: These are mobile-first “super-apps” (e.g., GrabPay, GCash, OVO, GoPay) built on robust financial technology platforms that integrate payment, transport, food delivery, and other daily services, including direct gaming top-ups.

- Mobile Network Operators (MNOs): Telcos leverage their billing infrastructure to offer direct carrier billing, allowing users to charge in-game purchases directly to their mobile phone bill or prepaid credit, a technology known as Direct Operator Billing.

- Payment Gateways & Aggregators: Companies like Xsolla, Razer Gold, and specialized local payment processors provide the technical APIs and frameworks to integrate various regional payment methods (including wallets and top-ups) into gaming platforms, simplifying complex payment routing for game developers.

- Physical Voucher/Top-Up Networks: Retail chains and convenience stores serve as physical points of sale where users can exchange cash for digital gaming credits or wallet top-ups, leveraging POS (Point of Sale) terminal technology to convert physical currency into digital value.

- Specialized Gaming Payment Platforms: These platforms are custom-built with gamers in mind, often offering unique technological features like loyalty programs, exclusive in-game deals, and streamlined checkout flows optimized for specific gaming content.

Conclusion: Drive Action

The transformation of payment systems in Southeast Asia, largely driven by the widespread adoption and continuous technological evolution of digital wallets and mobile top-up services, is unequivocally powering the region’s burgeoning gaming economy. This shift has not only made online transactions more accessible and convenient for millions of players, including the unbanked, but has also opened up unprecedented revenue channels and market reach for game developers and publishers. The future of digital payments SEA gaming points towards even greater technological integration, innovation, and a seamless transactional experience that will continue to fuel the industry’s explosive growth.

Actionable Steps:

- For Gaming Developers/Publishers (Leveraging Technology):

- Integrate Localized Payment APIs: Prioritize technological partnerships with prominent digital wallets and mobile top-up service providers to ensure seamless, region-specific payment flows.

- Optimize Mobile Transaction UX: Design your in-game purchase interfaces for intuitive mobile use, leveraging features like one-tap payments and biometric authentication to reduce friction.

- Utilize Payment Analytics: Implement analytics tools to track payment method performance and user preferences in different SEA countries, informing your strategic technology investments.

- For Players (Embracing Payment Tech):

- Explore Digital Wallet Apps: Download and familiarize yourself with popular digital wallet applications in your country for convenient, secure, and often rewarding gaming transactions.

- Understand Top-Up Options: If you prefer cash, learn about the various mobile top-up services available to easily convert physical currency into digital game credits or wallet funds.

- Prioritize Secure Practices: Always use strong passwords, enable multi-factor authentication for your digital payment accounts, and be aware of common phishing scams to protect your transactions.

FAQ Section

Why are digital wallets so popular in SEA gaming?

Digital wallets are popular due to high mobile penetration, lower credit card adoption, and their ability to facilitate instant, secure, and convenient transactions for a large, often unbanked, gaming population, supported by robust mobile payment technology.

What are mobile top-up services, and how do they work for gaming?

Mobile top-up services allow users to convert cash into digital credits via physical outlets or mobile carrier billing. These credits can then be used to purchase in-game items directly or load into digital wallets, leveraging existing telecom and retail payment infrastructure.

Is cash still relevant for online gaming payments in SEA?

While digital payments are growing rapidly, cash remains indirectly relevant. Many digital wallets and mobile top-up services allow users to load their accounts with physical cash, effectively bridging the gap between traditional cash preferences and the digital economy through accessible top-up networks.

How do these payment trends impact game developers from a technological standpoint?

These trends significantly benefit game developers by expanding their accessible market, enabling seamless API integrations for various local payment methods, reducing transaction friction, and providing diversified revenue streams through adaptable payment technology.

Are there security risks with using digital wallets for gaming, and how is technology addressing them?

Digital wallets employ robust security features like encryption, tokenization, and multi-factor authentication (e.g., biometrics) to mitigate risks. Continuous technological advancements in fraud detection and secure data handling are key to protecting user transactions.

What is the role of companies like Cocodp in this payment ecosystem?

Companies like Cocodp play a vital role by providing specialized digital payment solutions and services that cater to local market needs, including mobile top-ups and digital currency distribution, leveraging their technology platforms to support the gaming and entertainment sectors.

Will traditional credit cards become obsolete for SEA gaming payments due to new tech?

While their dominance is decreasing, credit cards are unlikely to become completely obsolete. They will likely remain an option for certain demographics or larger transactions, but digital wallets and mobile top-up services, powered by evolving mobile and internet technologies, will continue to be the primary drivers of growth and accessibility in the region’s gaming payment landscape.